Peace Of Mind Benefits Of Having A Tailored House Insurance Plan In Place

Imagine waking up every day knowing your home—and everything in it—is fully protected just the way you need. That’s the peace of mind a tailored house insurance plan can give you.

When your insurance fits your unique situation, you’re not just covered—you’re confident. You’ll discover how customizing your house insurance can shield you from unexpected costs, ease your worries, and keep your family safe. Keep reading to find out why a one-size-fits-all policy might be costing you more than you think—and how a personalized plan puts control back in your hands.

Credit: www.pureinsurance.com

Tailored Coverage Options

Tailored coverage options in house insurance give you control over your protection. You choose what suits your home and lifestyle. This way, your insurance plan fits your needs perfectly. No overpaying for coverage you do not need.

Customizing Protection Levels

Insurance plans let you pick how much protection you want. You can raise or lower coverage based on your budget. This flexibility helps balance cost and safety. It also lets you update protection as your needs change.

Including Valuable Assets

Your home may have special items like jewelry or art. Standard insurance might not cover these enough. Tailored plans include extra protection for valuable assets. This ensures you get fair compensation if these items are damaged or lost.

Addressing Unique Risks

Every home faces different risks, like floods or earthquakes. Tailored insurance can cover these specific dangers. You avoid gaps in your protection. Peace of mind grows knowing your unique risks are covered.

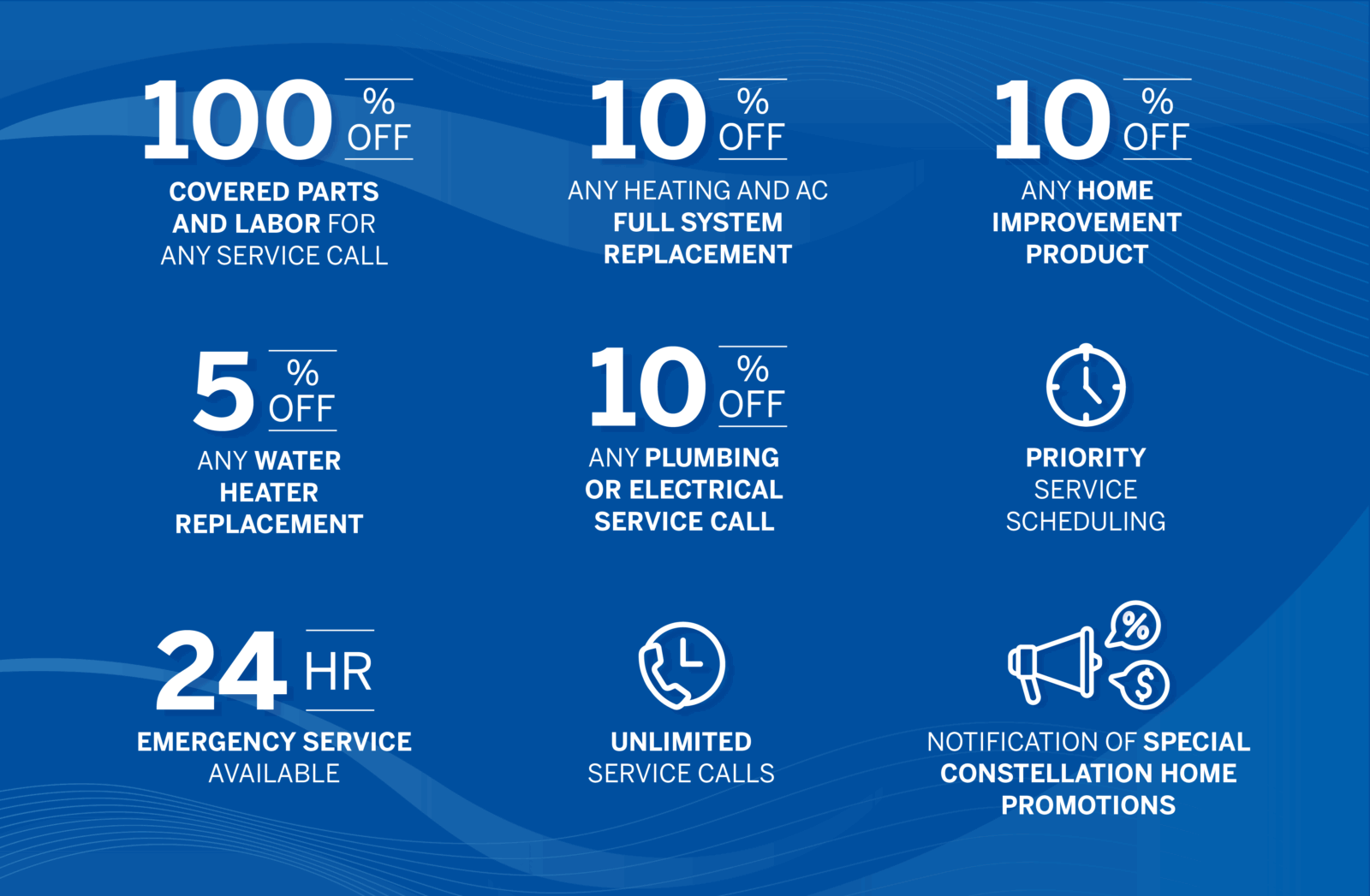

Credit: www.constellationhome.com

Financial Security

Financial security is a key benefit of having a tailored house insurance plan. It helps protect your money from unexpected events that could cost a lot. A plan made just for your needs can cover the risks you face. This way, you avoid paying large sums out of your own pocket.

Minimizing Out-of-pocket Expenses

A tailored insurance plan lowers the money you pay during damage or loss. It covers repairs, replacements, and other costs. This helps you avoid sudden financial stress. You only pay a set premium, not huge emergency bills.

Safeguarding Against Unexpected Costs

Unexpected events like storms or theft can cause big losses. A custom plan protects you from these surprises. It ensures you have support to fix or replace your belongings. This protection keeps your finances stable and secure.

Budget-friendly Premiums

Tailored plans let you choose coverage that fits your budget. You pay for what you need, not extra services. This control makes house insurance affordable. It allows you to manage costs while staying protected.

Stress Reduction

Stress can hit hard when unexpected events damage your home. A tailored house insurance plan cuts worry by covering what matters most. It gives you calm and control, even during tough times. Understanding how it reduces stress helps you see its true value.

Confidence During Emergencies

Emergencies feel less scary with a clear insurance plan. You know what is covered and what steps to take. This clarity lets you act fast and stay calm. No guessing or confusion. Confidence grows from knowing help is ready.

Simplified Claims Process

A tailored plan makes claims easy and fast. It matches your needs, so paperwork is simple. Quick claims mean less waiting and less stress. You can focus on fixing your home, not endless forms. Peace comes from smooth, hassle-free support.

Reliable Support Network

Insurance connects you to trusted experts and service providers. They respond quickly to your calls for help. This network stands by you in difficult times. Knowing help is near eases your mind. You are never alone with reliable support.

Enhanced Property Value

Having a tailored house insurance plan adds more than just protection. It also helps increase your property’s value. This benefit gives you peace of mind. You know your home investment is safe and growing.

Protecting Home Investments

Your home is one of your biggest investments. Custom insurance covers specific risks your property faces. This coverage reduces the chance of losing money due to damage. It keeps your home’s value steady even after accidents or natural events.

Insurance helps pay for repairs quickly. Quick fixes stop small problems from becoming big ones. This care keeps your home in good shape. A well-maintained home holds its value better over time.

Boosting Resale Appeal

A tailored insurance plan shows buyers you care about your home. It proves the house has been protected and well-kept. Buyers feel safer paying more for a home with good coverage history.

Insurance records also make selling easier. They provide proof of maintenance and repairs. This transparency builds trust with potential buyers. Higher trust often means a better sale price.

Long-term Benefits

Having a tailored house insurance plan offers benefits that last for years. It provides peace of mind knowing your coverage grows with your needs. This plan protects your home and valuables as life changes. It also helps avoid gaps in protection, keeping you safe long-term.

Adapting To Life Changes

Life changes often affect your home insurance needs. Moving to a bigger house or renovating calls for updated coverage. A tailored plan adjusts to these changes easily. It ensures your policy matches your current situation. This way, you avoid paying for unnecessary coverage. Or lacking protection when you need it most.

Ensuring Continuous Coverage

Continuous coverage prevents costly gaps in protection. Tailored insurance keeps your home covered without interruptions. It helps you stay protected against damage or loss every day. Regular reviews of your plan make sure it stays up to date. This steady protection saves money and stress in the long run.

Credit: www.idealins.com

How Smart Pets Lover Can Help You with Peace Of Mind Benefits Of Having A Tailored House Insurance Plan In Place

Learning from Tailored Coverage: A Path to Peace of Mind

Understanding the peace of mind that comes from a tailored house insurance plan often opens doors to practical learning opportunities. As we’ve explored, financial security and stress reduction are key benefits that ripple into everyday life. Delving deeper, this knowledge encourages pet parents—whether caring for playful dogs or curious cats—to consider how personalized protection can safeguard both their homes and furry friends.

For example, exploring tailored coverage options can inspire you to evaluate your unique needs, teaching valuable lessons in risk management and preparedness. This approach aligns with Smart Pets Lover’s mission to empower families to feel confident and connected—not just with their pets but in managing the unexpected.

- Review your current insurance policies alongside your household’s specific risks.

- Learn how enhanced property value ties into comprehensive protection strategies.

- Use trusted resources to stay informed about best practices in home and pet safety.

For those curious to deepen their understanding, reaching out to local insurance advisors or visiting community workshops can provide practical insights without stress. Remember, peace of mind isn’t just about coverage—it’s about feeling prepared and secure, so every wag, purr, and chirp truly tells a story of safety and love.

Frequently Asked Questions

What Is A Tailored House Insurance Plan?

A tailored house insurance plan is customized coverage designed to fit your home’s specific needs. It protects your property and belongings against risks unique to your location and lifestyle. This personalized approach ensures you only pay for necessary coverage, offering better peace of mind.

How Does Tailored Insurance Improve Peace Of Mind?

Tailored insurance reduces worry by covering all relevant risks specific to your home. It eliminates gaps in coverage, ensuring you’re protected from unexpected events. Knowing your insurance matches your needs helps you feel secure and confident about your home’s safety.

Why Choose Tailored Over Standard House Insurance?

Tailored insurance offers personalized protection, unlike standard plans that have generic coverage. It addresses your home’s unique risks and valuables, providing comprehensive security. This customization often results in better value and satisfaction, as you only pay for what you truly need.

Can Tailored House Insurance Save Money Long-term?

Yes, tailored insurance can save money by avoiding unnecessary coverage and reducing claim issues. It targets specific risks, potentially lowering premiums. Over time, this focused protection prevents costly gaps and ensures efficient claims, making it a financially smart choice.

Conclusion

A tailored house insurance plan brings real peace of mind. It fits your needs and protects your home well. You avoid paying for coverage you do not need. Costs stay manageable and claims get handled faster. Knowing your home is secure lets you relax more.

You focus on living, not worrying about risks. A custom plan keeps your family safe and secure. Choose smart protection that works for you every day. Peace of mind starts with the right insurance plan.